Rumored Buzz on Retirement Income Planning

Table of ContentsRetirement Income Planning Can Be Fun For AnyoneThe Only Guide for Retirement Income PlanningRetirement Income Planning Fundamentals ExplainedRetirement Income Planning - The FactsThe Greatest Guide To Retirement Income Planning

In addition, there are actually options to deliver a benefit to your inheritors, if that is actually a possibility that is necessary to you. While each sort of annuity may use an appealing mix of attributes, team up with your financial expert to aid establish which allowance or even a mixture of annuities pertains for you in developing a varied earnings strategy.You'll would like to think about exactly how you can spend for those exciting things you've constantly dreamed about doing when you finally have the timethings like vacations, pastimes, and other nice-to-haves. It's a wise method to pay out for these sort of costs from your assets. That's due to the fact that if the marketplace were to conduct poorly, you could always reduce on several of these expenditures.

8 Simple Techniques For Retirement Income Planning

The retirement life realities experiencing Americans continue to transform. Our lifespans are longer, and also standard sources of retired life income might certainly not deliver the security they as soon as performed. Just how will you ensure you have good enough to reside properly, for so long as you require it? Retirement life profit preparing leverages your riches to assist create predictable revenue that satisfies your needs for today and also tomorrow.

, on the various other hand, is after tax obligation as well as may generate tax-free revenue when distributions are trained. * This implies that if you possess a sizable portion of your retirement financial savings in Roth profiles, your income substitute rate must be lesser.

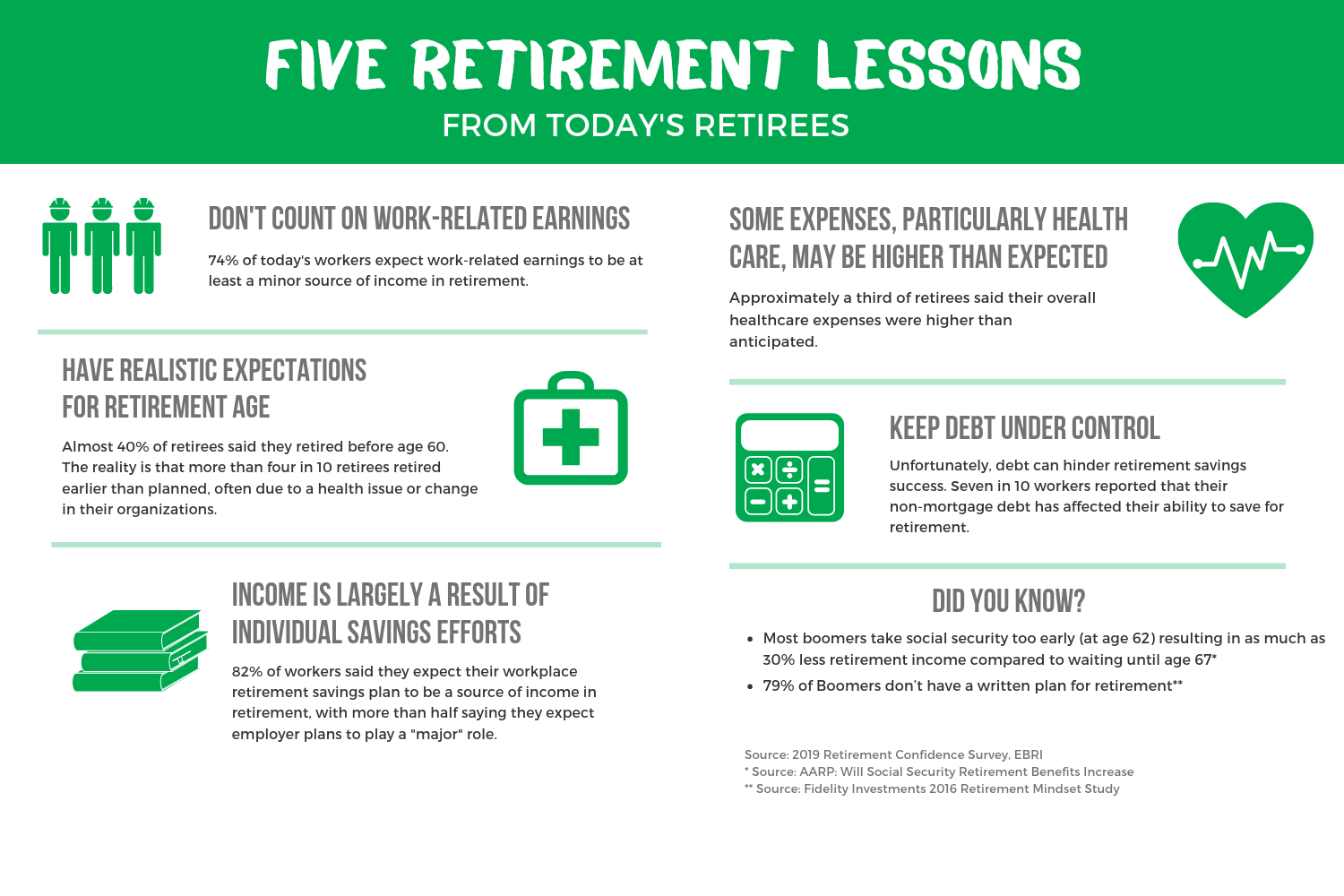

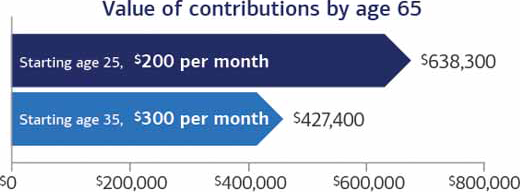

Many Americans have actually been identified that one of the most necessary pieces of advice regarding except for retired life is to start early. While some heed that suggestion as quickly as they hear it, others need to have to become advised to spare. Even more than 38 million people (that's 45% of working-age homes in the U.S.) possess no retirement discounts at all.

The Retirement Income Planning Ideas

Whether you are actually simply starting or are actually better to retired life, you'll intend to make certain that your revenue lasts just as long as you require it. The encouraging news is actually that, wherever you are actually at whether it's ahead or even at the back of there are actually some basic points you a fantastic read can start performing today to much better plan for a pleasant retirement.

Coming from certainly there, number out if there are any sort of easy techniques you may cut down on needless investing, and spare that newfound money in a retirement life fund. Charge card personal debt may be a major misfortune to retired life organizing. If you possess charge card with high rate of interest, pay out off the financial debt as very soon as possible in order that rather than paying for the sizable rates of interest on your expenses, you may add that cash to a retirement life savings account.

The juice machine explains the type of retirement life income organizing review our team use to assist you get every little of earnings you can (within reason) coming from the resources you presently have (retirement income planning). How does it operate? Our experts operate iterations of your program to find techniques you can easily: Apply a policies located strategy to your investment decisions, Lessen expenditure expenditures, Coordinate your livelihoods in an income tax efficient means, Lessen your risk of managing out of loan, Generate reputable resources of retirement life profit, Program for, or around, scheduled prolonged compensation payouts, Case Social Surveillance in a technique to make the most of capital, Smartly departure concentrated spots in provider equity, Use Roth conversions to your conveniences Even more extract may be gauged in relations to increased after-tax capital, a more significant chance of success, and/or even more possessions available to reach to beneficiaries.

Examine This Report on Retirement Income Planning

Can our company guarantee our team can enhance your retirement life revenue through this preparation process? Our team carry out locate that our team may commonly reveal you which decisions will definitely make a relevant distinction.

There are a lot of things to think about when it happens to promised retirement life earnings. What kind of guaranteed retired life revenue strategy is actually well for you? Our team are going to explain how to equip retired life by spending in guaranteed retired life earnings as well as the various types of plannings available.

Retirement Income Planning Fundamentals Explained

An additional webpage debate would certainly be if the program would still be about later on or even improvement entirely coming from today's standards, which can be a substantial wrench in any kind of plan. Presently, allowances are actually the only individual retirement account that guarantees a paycheck for a whole entire life-time or even life times, in the profile. Allowance owners may handle the amount of intended revenue they acquire later on via postponed pension programs.

You function hard for your money. You prefer to make sure that it is going to be there when you need it whether for retirement life, a stormy time fund, or one thing else. When it comes to retired life profiles, there are a lot of myths drifting about.